Hong Kong has absolutely nothing versus brief sellers. That might be simply as well.

0;

When regulators worldwide prohibited these bearish financiers throughout the monetary crisis, Hong Kong decreased to follow, previous Securities and Futures Commission head Martin Wheatley mentioned on Wednesday. The city went on to establish the world’’s finest and most robust short-selling system, he stated.

Recent occasions recommend Hong Kong’’s stock exchange has no scarcity of work for these regularly damned market predators, who play an essential function in offering liquidity and allowing rate discovery besides their more lurid track record for exposing business misbehavior.

Muddy Waters LLC’’s

0; Carson Block and GeoInvesting LLC &#x 2019; s Dan David revealed 2 more targets on Wednesday at the Sohn Hong Kong conference, the exact same online forum where Wheatley spoke.

0; Man Wah Holdings Ltd.

0; and

0; Dali Foods Group Co.

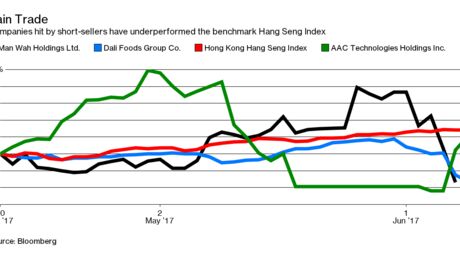

0; sign up with an ever-growing list of Hong Kong business that have actually discovered themselves ending up being brief sellers’’ victim.

At least 20 have actually entered the cross-hairs over the previous 12 months, well above the displaying in previous years. This might be partially attributable to hedge funds tiring exactly what one scholastic has actually called

0; the “”low-hanging fruit”” of New York- and Nasdaq-listed Chinese companies. Hong Kong’’s market provides a number of the exact same attributes: in essence, an abundance of mainland Chinese companies whose accounting practices are less transparent than they may be.

0;

Man Wah, a furnishings maker, plunged 10 percent on Wednesday prior to being suspended pending a declaration, having actually dropped 8.6 percent the previous day on speculation it was a target. Muddy Waters’ Block stated he discovered proof of concealed financial obligation at’ the business and was shorting the stock.

Dali Foods, maker of the

0; Hi-Tiger energy beverage, dropped 6.5 percent after GeoInvesting’s David questioned the business’s accounting and divulged his brief position. The shares rebounded to trade greater at the midday break on Thursday after Dali Foods stated accusations versus it were misguiding.

Attacks by brief sellers have not constantly turned out, however they have actually scored enough triumphes to send out financiers scampering as soon as a brand-new victim is determined. In December, Block declared that China Huishan Dairy

0; Holdings Co. had overemphasized its sales , misrepresented its self-sufficiency in alfalfa and made an unannounced transfer of possessions. 6 months later on, Huishan shares are suspended after falling 85 percent in one day, all its directors have actually stopped or been eliminated

0; bar the chairman, and the business is dealing with several legal procedures.

On the other side of the journal: AAC Technologies Holdings Inc. The provider of parts to Apple Inc. has actually been the topic of an unusual battle in between short-focused scientists, with

0; Anonymous Analytics protecting the business versus accusations by Gotham City Research. AAC shares, which plunged after Gotham’s report in May, leapt the most in 8 years on Wednesday.

The contention by Wheatley, likewise a previous head of the U.K.’s monetary regulator, that brief selling can include worth to markets might have raised some eyebrows amongst his audience.

0; Andrew Left of Citron Research

0; was prohibited for 5 years and fined in 2015 after a Hong Kong tribunal discovered he released deceptive and/or incorrect details about China Evergrande Group. Critics stated the case, brought by the SFC, would have a chilling result on independent analysis.

Some short-seller reports have actually presaged action by the regulator. The SFC won a court order in 2015 to end up China Metal Recycling Holdings Ltd. , when the country’s greatest scrap-metal recycler. Glaucus Research Group called the business a scams in a January 2013 report.

Tianhe Chemicals Group Ltd. has actually been stopped from trading because March 2015 after Anonymous Analytics declared overstatement of revenues and other accounting abnormalities, months after the business’s Hong Kong IPO. The SFC last month bought Tianhe to stay suspended under a guideline that permits it to require a stop when it thinks there’s proof of deceptive, insufficient or incorrect info .

These cases demonstrate how independent scientists’can signal financiers to issues that might have been missed out on by regulators and other gatekeepers. The shorts do certainly supply worth to the marketplaces. Maybe it’s time all the tough things wasn’t delegated them.

This column does not always show the viewpoint of Bloomberg LP and its owners.