U.S. President Donald Trump said the current trade spat with China may hurt the markets in the short term but that America will emerge stronger from it, as a confrontation that has roiled global equities heats up between the world’s two largest economies.

“I’m not saying there won’t be a little pain,’’ Trump said Friday during an interview on 77 WABC Radio’ “Bernie & Sid in the Morning’’ program. “So we might lose a little of it but we’re going to have a much stronger country when we’re finished, and that’s what I’m all about.’’

Stocks opened lower on Wall Street with the S&P 500 Index down 0.7 percent at 9:34 a.m. in New York.

At almost the same time as Trump spoke, a senior Chinese government official in Beijing repeated a vow from earlier that day that the country would “retaliate immediately, intensively, without any hesitation” if the U.S. releases new list of tariffs on $100 billion additional imports. China has prepared for more U.S. trade measures and has drafted detailed retaliatory measures, Chinese Ministry of Commerce spokesman Gao Feng said.

We are not in a trade war with China, that war was lost many years ago by the foolish, or incompetent, people who represented the U.S. Now we have a Trade Deficit of $500 Billion a year, with Intellectual Property Theft of another $300 Billion. We cannot let this continue!

— Donald J. Trump (@realDonaldTrump) April 4, 2018

The dispute has intensified since late on Thursday when Trump ordered his administration to consider tariffs on an additional $100 billion in Chinese goods, sending U.S. stock futures tumbling. He cited “China’s unfair retaliation” in response to his list of proposed tariffs earlier this week covering $50 billion in Chinese products.

Trump said falling aluminum prices was proof his get-tough trade policies are working in a Twitter message Friday morning. “Despite the Aluminum Tariffs, Aluminum prices are DOWN 4%. People are surprised, I’m not! Lots of money coming into U.S. coffers and Jobs, Jobs, Jobs!” he said in a posting.

Steel Tariffs

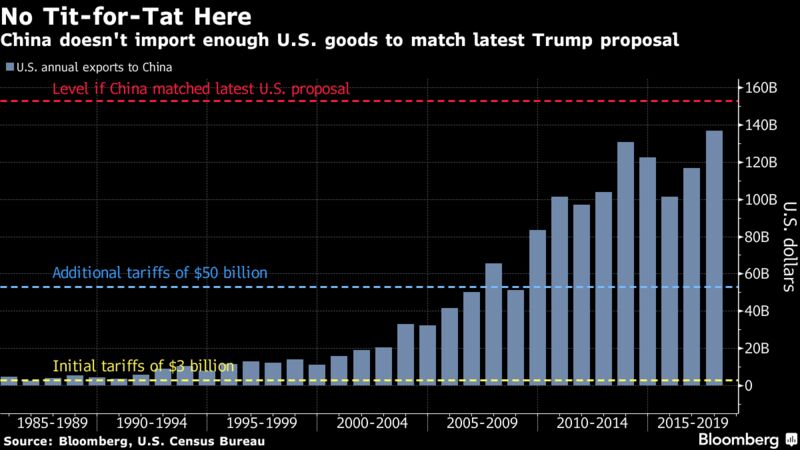

Earlier this month, China announced tariffs on $3 billion of U.S. goods such as pork and wine in retaliation for the steel and aluminum tariffs imposed last month by Trump.

Trump’s unexpected move on China threatens to unravel efforts by top U.S. and Chinese trade officials to lower the heat and reach an agreement that could stave off an escalating conflict. Administration officials have spent the past two days trying to tamp down fears of a trade war, with chief economic adviser Larry Kudlow saying Thursday the U.S. could still hammer out a deal with Beijing.

READ MORE:

“By fueling uncertainty among market participants, fears of a ‘trade war’ have added to the volatility already witnessed earlier this year in equity markets,” Benoit Coeure, a member of the European Central Bank’s executive board, said in Cernobbio, Italy. “None of this supports growth and employment.”

Trump said U.S. Trade Representative Robert Lighthizer would identify which new products may be subject to tariffs. The administration later stressed that any additional tariffs first would be subject to a 60-day public comment period.

“No tariffs will go into effect until the respective process is complete,” Lighthizer said in a statement. The administration hasn’t said when any of the proposed tariffs would go into force.

China said Wednesday it would levy a 25 percent tariff on about $50 billion of U.S. imports including soybeans, automobiles, chemicals and aircraft. That was in response to Trump’s proposed tariffs targeting industries including aerospace, robotics and machinery.

Cheap Talk

Peter Navarro, White House trade adviser, said “talk hasn’t been cheap with China,” during a Fox News appearance Friday. He said the administration anticipated U.S. agriculture would be the first point of retaliation and said Trump “will have the backs” of America’s farmers.

“The message he’s sending to China is this: He has a great relationship with the president of China. This is business,” Navarro said. “And this is the kind of business where we have to stand firm against China’s unfair trade practices.”

Were China to want to match Trump’s latest threat, it wouldn’t have enough American goods imports to target. It could take other measures like curbing package tours or student transfers to the U.S., or hamper American companies operating in China.

“This is starting to feel like the beginnings of a trade war, if simply each proposal is matched with a retaliation,” said Patrick Bennett, a Hong Kong-based strategist at Canadian Imperial Bank of Commerce. “The U.S. risks isolating itself from global trade in this process and we think the U.S., USD and U.S. asset markets have more to lose.”

Trump struck a defiant tone during a speech in West Virginia on Thursday, saying it was time to stop China from “taking advantage” of America.

“You have to go after the people who aren’t treating you right,” Trump said. “We’re going to have a fantastic relationship long term with China, but we have to get this straightened out. We have to have some balance.”

What Our Economists Say…The Trump threat “raises the possibility of an alarming escalation in the trade conflict between the world’s two biggest economies,” Tom Orlik, Bloomberg Economics chief economist, wrote in a note. “It’s difficult to tell the difference between a rhetorical flourish from a president known for bombastic remarks and a meaningful shift in policy.” |

Read more: http://www.bloomberg.com/