-

SocGen sees potential 18% drop in S&P 500 on earnings risk

-

Birinyi stays optimistic, saying Apple’s bull case is intact

In a week where equity investors got spooked by higher rates and peaking growth, robust earnings from tech giants fell just short of keeping the market afloat.

Stocks got slammed Tuesday when Caterpillar’s “high water mark” comments on profit came just hours after the first 3 percent yield on 10-year Treasuries in four years. It took earnings-fueled rallies from heavyweights Facebook and Amazon in the final two days to save the S&P 500 from a rout in the week.

Gone from what’s so far been the best earnings season on record is the once-unbridled confidence in economic growth that sent equities to all-time highs in January. In its place is the fear that corporate profit can only go downhill if the bump from tax cuts is over and higher borrowing costs cause trouble for an economy that’s already showing signs of slowing.

One bearish case against buying into the robust growth story is that it may not last. Around the world, economic data are trailing forecasts, casting a shadow on the synchronized recovery that propelled the equity rally last year. At the same time, cost pressure from wages and raw materials seems to be gaining momentum.

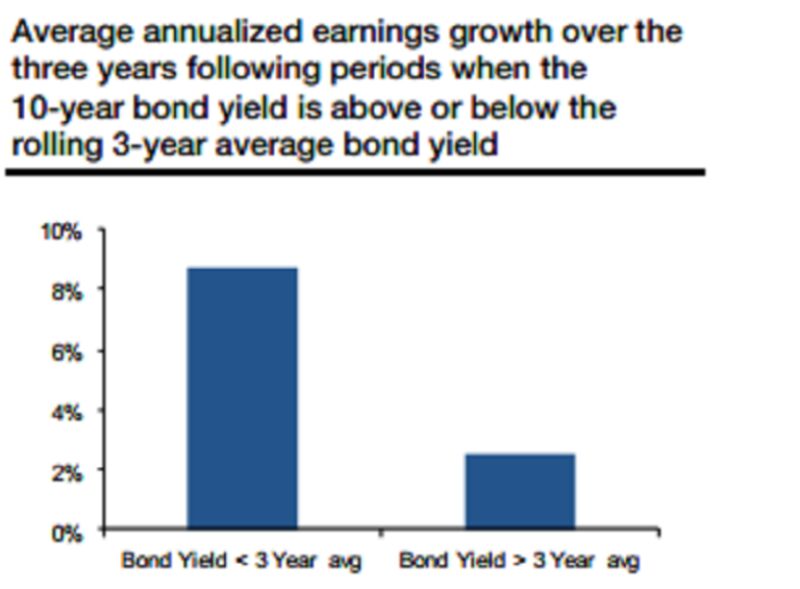

Analyst earnings estimates look too optimistic, particularly when borrowing costs are rising, according to Societe Generale. The firm studied the 10-year Treasury yield and corporate profits and found they have shown an inverse relationship over the past three decades.

Specifically, when yield was above the three-year average, as is the case now, earnings tended to expand an average of about 2 percent in the subsequent three years. That’s less than a third of the pace seen when yield was lower.

Strategists led by Alain Bokobza warned that the S&P 500 could fall as much as 18 percent should profits stay flat in 2019 and 2020.

“Optimism on earnings from 2019 onward might be misplaced,” the strategists wrote in a note to clients Friday. “Any lowering of near-term earnings growth expectations could be a potential trigger for an equity market correction.”

Not everyone is as pessimistic. Laszlo Birinyi, a steadfast bull during the nine-year U.S. equity rally, is sticking to his forecast that the S&P 500 will rise back toward its January peak, hitting 2,860 by June.

While Apple shares have lost more than 10 percent from a March high heading into next week’s earnings report, Birinyi said his firm is holding on to the stock because concern over iPhone X demand is nothing new and the company’s product launches have always been greeted with skepticism.

Meanwhile, concerns over a global slowdown look unwarranted to Birinyi, who observed that shares of luxury-goods producers are rallying. LVMH, owner of the Louis Vuitton brand, has jumped 17 percent this year while Gucci’s parent company Kering SA is up 22 percent.

“If this segment of the market is doing well, we have to be encouraged about the economy,” Birinyi said. “Investors should look through the current storm clouds, but not ignore them, as we continue to expect higher prices.”

Read more: http://www.bloomberg.com/