One of the worlds most conservative financiers has actually discovered a not likely brand-new ally in among its most flamboyant political leaders: Donald Trump.

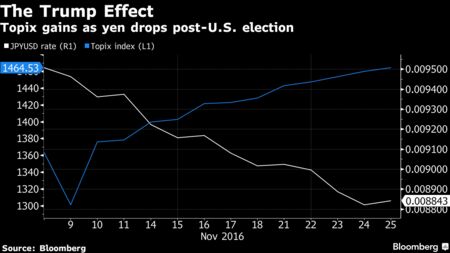

The non-traditional president-elects triumph is assisting Japans huge pension fund in 2 essential methods. Its sending out stock markets rising, both at house and overseas, which is great news for the mostly passive equity financier. Second, its stimulated a tumble in the yen, which increases the worth of its abroad financial investments. After the $1.2 trillion Government Pension Investment Fund reported its very first gain in 4 quarters, experts are wagering the Trump aspect implies theres more great news to come.

The Trump market will be a tailwind for Abenomics in the near term, stated Kazuhiko Ogata, the Tokyo-based chief Japan financial expert at Credit Agricole SA. And GPIF will be the greatest recipient amongst Japanese financiers.

While the majority of experts were worried a Trump success would injure equities and reinforce the yen, the opposite has actually held true. Japans benchmark Topix index travelled into a booming market recently and has actually increased for 11 straight days. The 4.6 percent downturn on Nov. 9 now appears a far-off memory. The yen, on the other hand, is moving towards its greatest month-to-month drop versus the dollar because 2009.

GPIF published a 2.4 trillion yen ($21 billion) financial investment gain in the 3 months ended Sept. 30, after more than 15 trillion yen in losses in the previous 3 quarters. Those losses eliminated all financial investment returns considering that the fund revamped its method in 2014 by cutting and increasing shares financial obligation. It held more than 40 percent of properties in stocks, and nearly 80 percent of those financial investments were passive at the end of March.

Read more: Worlds Biggest Comeback Breathes Life Into Japans Equity Bulls

Tokyo stocks are gaining double benefits from Trump, as the weaker yen enhances the revenues outlook for the countries exporters. The Topix is the fifth-best entertainer given that Nov. 9 amongst 94 main equity indexes tracked by Bloomberg.

Global Rally

But theyre not the only ones. More than $640 billion has actually been contributed to the worth of international stocks considering that Nov. 10, when lots of markets worldwide began to get on bets Trump would let loose financial stimulus and stimulate inflation, which has actually enhanced the dollar and deteriorated the yen. The S&P 500 Index closed Wednesday at a record high in New York.

Bonds have actually toppled for the very same factors, with around $1.3 trillion rubbed out the worth of an index of worldwide financial obligation over the exact same duration. Japans benchmark 10-year sovereign yield touched a nine-month high of 0.045 percent on Friday, rising from as low as minus 0.085 percent on Nov. 9.

GPIFs go back to earnings is a welcome reprieve after critics in the house berated it for taking on too much danger and putting the general publics retirement cost savings in jeopardy.

Also see: A QuickTake on Japans huge pension fund

The funds purchases of stocks are a gamble, opposition legislator Yuichiro Tamaki stated in an interview in September, after a nearly 20 percent drop in Japans Topix index in the very first half of the year was followed by a 7.3 percent one-day plunge after Britains shock vote to leave the European Union. Prime Minister Shinzo Abe stated that month that short-term losses aren’t an issue for the nations pension financial resources.

Feeling Vindicated

Id envision GPIF is feeling practically vindicated, stated Andrew Clarke, Hong Kong-based director of trading at Mirabaud Asia Ltd. It needs to be meticulously positive about Trump.

Still, optimism about Trump is preceding his policies, and some financiers are questioning the length of time the advantages for Japan– and GPIF– can last. Trump has currently stated hell withdraw the United States from the Trans-Pacific Partnership trade pact on his very first day in workplace. The TPP is viewed as an essential policy for Abes federal government.

It looks helpful for GPIF in the meantime, stated Naoki Fujiwara, primary fund supervisor at Shinkin Asset Management Co. in Tokyo. Whether the market can continue like this is arguable.