Less than a years back, the International Monetary Fund utilized to discuss Asian nations accumulating excessive in their currency-reserve stockpiles.

The international monetary crisis turned that conclusion on its head, and now that U.S. rates of interest are poised to keep climbing up, the race is on to recognize which nations have the greatest buffers versus capital draining towards industrialized markets.

A step established by the IMF itself reveals that Thailand and the Philippines might be finest positioned to stand up to additional down pressure on the emerging currencies in Asia, based upon estimations taken prior to the Donald Trump-induced U.S. reflation play roiled the foreign-exchange market.

The IMF last month anticipated Thailands reserves at $163.3 billion at year-end, compared to the $64.9 billion required inning accordance with the so-called Assessing Reserve Adequacy gauge, which includes requirements from short-term financial obligation to loan supply, imports and financial investment circulations. The Philippines was moving towards a $84 billion stockpile, versus a $31 billion requirement.

In this broad pattern of the dollar strength– or emerging-market currency weak point– the currencies of nations that have a lot of reserves will most likely carry out much better than others, Tsutomu Soma, basic supervisor of fixed-income department in Tokyo at SBI Securities Co., stated in a phone interview. When you understand the financial authorities have plenty of loan to step in, you do not assault the currency. Rather, you try to find a currency that has less capability to protect it.

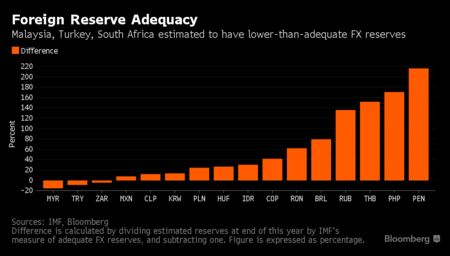

The procedure reveals Malaysia– not coincidentally the worst carrying out of the significant emerging Asian currencies versus the dollar this month– faring badly by contrast, with a $100 billion reserves forecast versus short-term external financial obligation of $128.2 billion, based upon IMF price quotes. Looking beyond Asia, Turkey, South Africa and Mexico are amongst those considered more susceptible by the evaluations.

Both Thailand and the Philippines increased their reserves in the last few years and have sufficient buffers to step in to smooth currency volatility,” stated Khoon Goh, head of Asia research study at Australia &&New Zealand Banking Group Ltd. in Singapore. Malaysias reserves are well below a May 2013 high, and the slimmer adequacy ratio restricts the capability for BNM to step in, he stated, utilizing the initials for the nations reserve bank.

ANZ is presently examining its currency projections in the middle of the existing sell-off in emerging markets, inning accordance with Goh.

Nations throughout Asia have actually currently been releasing their reserves, through intervention to avoid disorderly decreases, most likely making the IMFs year-end forecasts unattainable. Even with its included durability, the Philippines saw its peso drop to 50.00 per dollar for the very first time in 8 years Thursday. Thailand reported Friday that its reserves dipped to $177.2 billion since Nov. 18, below $181.6 billion 2 weeks previously.

There are monetary-policy ramifications for the currency decreases, too. Check out them here.

Reserve build-up began ending up being a focus after emerging Asian economies were hammered by plunging currencies throughout the Asian monetary crisis of 1997-98, when policy makers rapidly burned through their holdings. When financiers looked for just the best properties, a hard lesson throughout the international crisis last years was that even robust reserves might not be adequate. The Federal Reserve eventually supported the worldwide system through using U.S. dollar liquidity through swap contracts with equivalents covering the world.

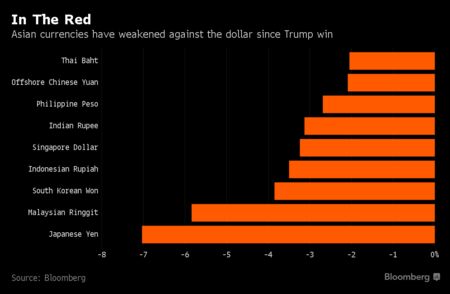

This time round, its less worry thats grasping markets than optimism about faster inflation in established economies must the inbound Trump administration prosper in broadening financial stimulus. Thats sped up fund outflows from the emerging markets. Worldwide financiers offered more than $12 billion of equities and bonds in Asias emerging markets given that Trumps triumph and the Bloomberg-JPMorgan Asia Dollar Index reached the most affordable level because March 2009.

While a lot of emerging markets might come under the very same selling pressures, those with weaker reserve buffers are most likely to do even worse.

Malaysia and Turkey are traditional example of nations whose reserve levels

are being up to a crucial level in contrast with the quantity of their short-term external financial obligation, Takahide Irimura, a financial expert at Mitsubishi UFJ Kokusai Asset Management Co., which manages about $114 billion, stated in a phone interview. “When the total market pattern is down, financiers are trying to find who is more weak and susceptible reserve position is likewise highlighted.