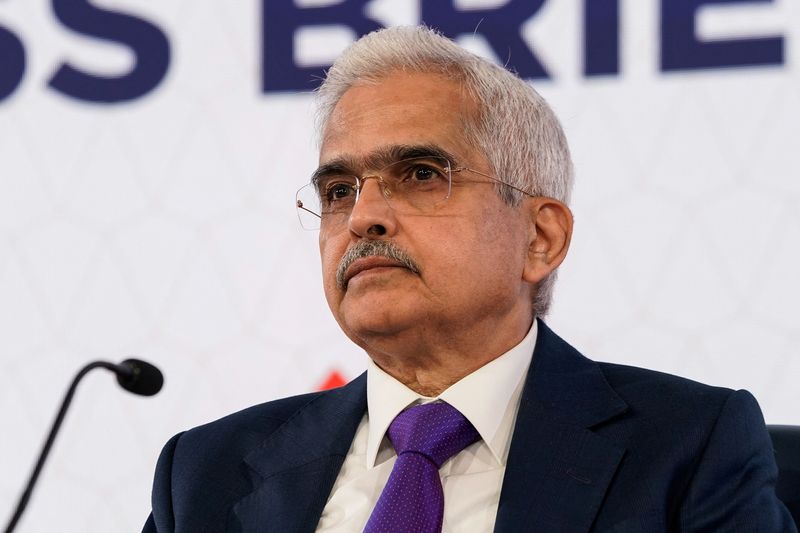

© News agency. SUBMIT IMAGE: Shaktikanta Das, guv of the Reservoir Banking Company of India, takes part in a press conference at the 2023 Springtime Appointments of the Realm Banking Company Team and also the International Monetary Fund in Washington, U.S., April thirteen, 2023. REUTERS/Elizabeth Frantz

BRAND-NEW DELHI (News Agency) -India’s rising cost of living has actually regulated, however remaining weather-related unpredictabilities still posture headwinds, the guv of the Reservoir Financial institution of India mentioned on Wednesday.

“The battle on rising cost of living is actually within, our experts need to continue to be sharp,” Shaktikanta Das mentioned at a celebration in New Delhi.

“There is actually no area for smugness. Our experts will certainly need to find exactly how the El Nino aspect participates in out.”

India’s yearly retail rising cost of living relieved to 4.7% in April coming from 5.66% in the previous month, depending on to federal government records.

This month’s retail rising cost of living records, planned to become discharged on June 12, “could possibly maybe be actually reduced,” Das mentioned.

The RBI targets rising cost of living at 4%, along with a resistance degree flexing approximately 2 percent factors on either edge.

El Nino might certainly not merely posture the danger of sustaining rising cost of living additionally it could possibly likewise evaluate on India’s economical development, Das mentioned. Geopolitical unpredictabilities, decreasing goods investing because of a tightening in worldwide field could possibly likewise threaten development, he flagged.

India’s GDP development can be over 7% for 2022-23, which ought to certainly not happen as an unpleasant surprise, the guv mentioned.

India is actually counted on to capture a GDP development of near 6.5% in 2023-24, he included.

The RBI targets to keep sensible and also act upon opportunity to make certain monetary reliability, continue to be practical in forex administration, and also concentrate on maintaining the rupee steady, Das mentioned.

The reserve bank is actually certainly not targetting at the “internationalisation” of the rupee, however it is actually a recurring method, the guv mentioned, incorporating that the RBI is actually still working with it.

Seventeen banking companies have actually opened up 65 exclusive vostro profiles to promote international sell rupee, Das mentioned. A vostro profile is actually a profile which a local area contributor financial institution hangs on part of an overseas financial institution.

The RBI has actually likewise enabled 18 nations to possess field resolution profiles, Das included.