Australian starlet Cate Blanchett wished to offer her house on Sydneys waterside. The purchaser who desired it was from China. The difficulty began right there.

Getting the cash from China showed difficult. The A$ 20 million ($14.9 million) cost was far in excess of the $50,000 limitation on exactly what Chinese are enabled to transform each year due to capital controls. The prospective purchaser couldnt settle, and the offer broke down– among lots of unsuccessful sales impacting Chinese nationals in Australia, inning accordance with a number of real estate agents managing such deals.

As Chinese people start an extraordinary purchasing spree of foreign residential or commercial property, the Blanchett case highlights how such loan circulations have actually produced a political and financial reaction, both in China and abroad. No place is this clearer than in Australia, the industrialized country most exposed to China.

Chinese authorities are stepping up capital curbs simply as myriad limitations in Australia have actually made home mortgages difficult to obtain for immigrants, putting purchasers from China in a sandwich capture that might damage the residential or commercial property market down under. While thats not unwanted for Australias reserve bank, which is eager to take some steam from increasing costs, it shines a light on the battle to absorb Chinas money exodus as it streams even more afield into places from Malaysia to Florida.

“People are discovering its really tough to obtain a home mortgage here then discover they cant get their loan from China, and theyre stuck, stated Lulu Pallier of Sothebys International in Sydney, who deals with high-end sales to Chinese purchasers.

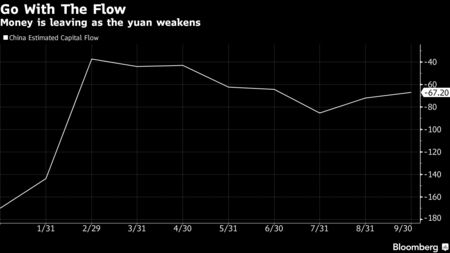

Chinese authorities fret that outflows of capital, intensified by the decreasing yuan, might be an ongoing chauffeur of decline. Approximated outflows in October reached $73 billion, getting once again after having actually slowed mid-year, according Capital Economics Ltd. Price quotes from Bloomberg Intelligence reveal about $620 billion drained in the 9 months through September.

President-elect Donald Trumps proposed tax cuts and facilities binge might speed up such circulations by accelerating U.S. development and inflation and pressing the Federal Reserve to raise rate of interest much faster than present market bets. The yuan has actually fallen practically 6 percent this year to the most affordable level considering that mid-2008.

“If the United States rates increase and the United States economy speeds up, it will refer time when more capital leaves China,” stated Stephen Jen, ceo of Eurizon SLJ Capital Ltd. and a previous International Monetary Fund economic expert.

Tighten Loopholes

Chinese banks have actually been informed to tighten up loopholes that permit people to avert capital controls, and authorities have actually begun detaining individuals in a project to avoid money finding its escape. Authorities have actually likewise prohibited pals or loved ones from organizing together currency quotas, suppressed the cross-border activities of underground banks and asked lending institutions to decrease foreign-exchange sales.

Still, there are a lot of alternative paths for identified purchasers. Entrepreneur can fund their house purchases through overseas trading business, while some Chinese designers permit customers to spend for abroad systems in yuan.

For a take a look at how Chinese money is improving Malaysias Johor Bahru, click on this link

But those who are successful in getting their loan from China are now facing increased constraints in Australia. In 2015, the federal government forced a business owned by Chinas Evergrande Real Estate Group Ltd. to offer an A$ 39 million Sydney estate, the highest-profile casualty of a crackdown on unlawful home-buying by immigrants.

This year, Australias 4 greatest lending institutions and Citigroup Inc. stated theyll not authorize home mortgage applications in Australia that depend on foreign earnings denominated in Chinese yuan and 4 other Asian currencies. Westpac Banking Corp. stated it wished to support Australians and irreversible locals home-buying rather.

Alternative Financing

So regional funding options are emerging. Australian billionaire designer Harry Triguboff has actually doubled the quantity hes providing to house purchasers, specifically those impacted by the Chinese capture, inning accordance with info supplied by his Meriton Group. Its home loan book has actually swelled by A$ 50 million over the previous 4 months to about A$ 120 million as bank financing dried up, it stated.

Australias reserve bank in its Financial Stability Review in October highlighted the danger from purchasers cannot close on home purchases. It stated the home market is revealing installing issue that this will end up being more typical in the cities of Brisbane, Melbourne and Perth.

These issues emerge from a mix of tighter funding conditions for buyers, specifically for non-residents and those reliant on foreign earnings, and evaluations at settlement listed below the contracted rate, the Reserve Bank of Australia stated.

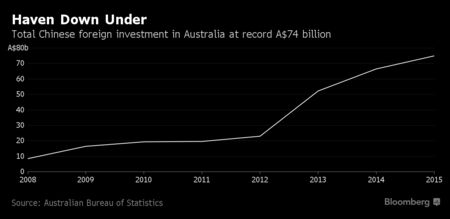

Australia authorized A$ 24 billion worth of Chinese property financial investments in the ended June 2015– or a quarter of all such approvals– inning accordance with the most current information offered. Chinese were without a doubt the biggest foreign purchasers, followed by Americans with $7 billion.

Additional Supply

Australian house rates have actually climbed up by more than 50 percent given that 2008 in the most significant cities, in part due to the fact that of Chinese purchases. Limitations on Chinese purchasers by both China and Australia might take some steam from Australias roaring east coast residential or commercial property market, offering the reserve bank scope to leave rate of interest the same for a prolonged duration as it looks for to support other locations of the economy.

Settlement problems from abroad purchasers indicates extra supply in pockets of urban Brisbane, Sydney and Melbourne where theres currently some emerging down pressure on costs, stated Su-Lin Ong, head of Australian financial and fixed-income method at Royal Bank of Canada in Sydney. If that has a wider causal sequence, together with a building cycle peak, it might provide the RBA more versatility.

Meanwhile, Oscar-winner Blanchetts sandstone manor in the Sydney residential area of Hunters Hill– with 6 bed rooms, a tennis court and a swimming pool with personal medical spa– is back on the marketplace. While theres still strong need for Australian residential or commercial property from Chinese purchasers, their failure to raise funds is moistening interest for handling the financially rewarding and formerly cash-laden group, inning accordance with Scott Kirchner, who runs China operations from Shanghai for Australias Beller home group.

We hesitate to handle brand-new customers unless they have 100 percent of the money for a home, he stated. Then theres the concern of how do they get the cash out of China.