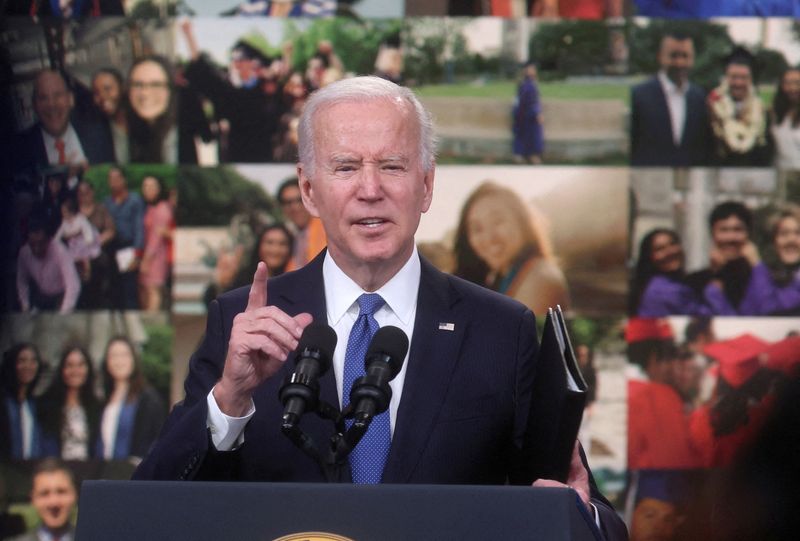

© Wire service. SUBMIT IMAGE: Commander In Chief Joe Biden supplies opinions regarding the pupil finance mercy course coming from a reception hall on the White Home university in Washington, U.S., Oct 17, 2022. REUTERS/Leah Millis

2/2

Through John Kruzel as well as Andrew Chung

WASHINGTON (Wire Service) -Conventional U.S. High court judicatures on Tuesday signified lack of confidence over the legitimacy of Head of state Joe Biden’s planning to call off $430 billion in pupil personal debt for around 40 thousand customers, along with the future of his plan that met an initiative commitment putting up in the harmony.

The 9 judicatures discovered debates in charms through Biden’s management of 2 reduced judge judgments blocking out the plan that he introduced final August in lawful obstacles through 6 conservative-leaning conditions as well as 2 personal pupil finance customers resisted to the planning’s qualifications demands.

Under the planning, the U.S. authorities will eliminate as much as $10,000 in federal government pupil personal debt for Americans creating under $125,000 that secured financings to spend for university as well as various other post-secondary education and learning as well as $20,000 for receivers of Pell gives to pupils coming from lower-income family members.

U.S. Lawyer General Elizabeth Prelogar, justifying Biden’s management, fought along with conventional fair treatments featuring John Roberts, Samuel Alito, Clarence Thomas as well as Brett Kavanaugh over the plan’s lawful reinforcement as well as justness. The courthouse possesses a 6-3 conventional bulk.

Roberts, the principal judicature, challenged whether the range of the alleviation was actually a plain adjustment of an existing pupil finance course, as made it possible for under the regulation the management pointed out as allowing it.

“Our team’re talking about half a trillion dollars and 43 million Americans. How does that fit under the normal understanding of ‘modify’?” Roberts asked.

The policy, intended to ease financial burdens on debt-saddled borrowers, faced scrutiny by the court under the so-called major questions doctrine, a muscular judicial approach used by the conservative justices to invalidate major Biden policies deemed lacking clear congressional authorization.

Alito challenged Prelogar’s assertion that Biden’s plan does not fit under the major questions paradigm, wondering whether members of Congress would regard, even colloquially, “what the government proposes to do with student loans as a major question or something other than a major question.”

“Of course, we acknowledge that this is an economically significant action,” Prelogar said. “But I think that can’t possibly be the sole measure for triggering application of the major questions doctrine.”

A 2003 federal law called the Higher Education Relief Opportunities for Students Act, or HEROES Act, authorizes the U.S. education secretary to “waive or modify” student financial assistance during war or national emergencies.”

Many borrowers experienced financial strain during the COVID-19 pandemic, a declared public health emergency. Beginning in 2020, the administrations of President Donald Trump, a Republican, and Biden, a Democrat, paused student loan payments and halted interest from accruing, relying upon the HEROES Act.

Roberts asked Prelogar whether the case presents “important issues about the role of Congress and about the role that we (the court) should exercise in scrutinizing that – significant enough that the major questions doctrine ought to be considered implicated?”

Biden’s plan fulfilled his 2020 campaign promise to cancel a portion of $1.6 trillion in federal student loan debt. Prelogar sought to cast it as “the administration of a benefits program” rather than an assertion of regulatory power not authorized by Congress.

Republicans have called the plan an overreach of Biden’s authority. Arkansas, Iowa, Kansas, Missouri, Nebraska and South Carolina challenged it, as did individual borrowers named Myra Brown and Alexander Taylor.

‘MASSIVE NEW PROGRAM’

Roberts told Prelogar the case reminded him of Trump’s effort – blocked by the Supreme Court – to end a program that protects from deportation hundreds of thousands of immigrants, often called “Dreamers,” who entered the United States illegally as children.

Kavanaugh said Congress in the HEROES Act did not specifically authorize loan cancellation or forgiveness and that Biden’s administration pursued a “massive new program.”

“That seems problematic,” Kavanaugh said.

Hundreds of demonstrators including borrowers rallied behind Biden’s relief plan outside the court. Biden wrote on Twitter, “The relief is critical to over 40 million Americans as they recover from the economic crisis caused by the pandemic. We are actually confident it’s legal.”

Some Republicans have attacked Biden’s plan as unfair because it benefits certain Americans – colleged-educated borrowers – as well as not other people.

Roberts presented Prelogar with a hypothetical scenario involving one person who borrowed to pay for college and another who borrowed to start a lawn-service business.

“We know statistically that the person with the college degree is going to do significantly financially better over the course of life than the person without. And then along comes the government and tells that person, ‘You don’t have to pay your loan,'” Roberts said. “Nobody’s telling the person who is trying to set up the lawn-service business that he doesn’t have to pay his loan.”

Prelogar responded to such “fairness” concerns raised by conservative justices by saying that “you can make that critique of every prior” government relief to various Americans under the HEROES Act.

The liberal justices raised doubts that the states had the proper legal standing to sue based on their claim that Biden’s plan would harm a single Missouri-based student loan servicing company, noting that the business did not itself bring the challenge.

The court’s rulings on the matter are due due to the finish of June.