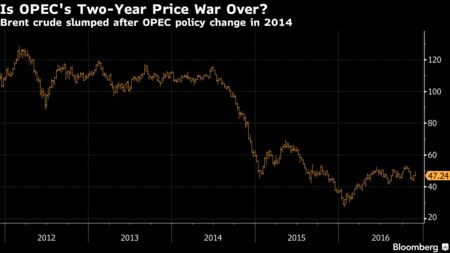

Even If OPEC Gets Deal, It Risks Reviving Battered Oil Rivals

Before an important assembly, OPECs offer to control drilling and ending years of world-wide oversupply hangs in the balance. But if ministers hash out a significant treaty on Wednesday, you will find risks for the petroleum-exporter club. By flooding the …